Health Insurance Explained

Alternative Coverage

RateQuote Direct,

The potential expiration of enhanced ACA subsidies is driving many consumers to explore lower-cost alternatives. If your household budget can't absorb a premium spike, you essentially have two paths outside of a standard ACA plan: Medicaid (free or very low-cost, comprehensive government coverage) or a Short-Term Health Insurance Plan (private, temporary, and generally cheaper, but with major coverage limitations). You must understand the profound differences between these two options before making a life-changing decision about your healthcare security.

1. The Safe Exit: Re-evaluating Medicaid Eligibility

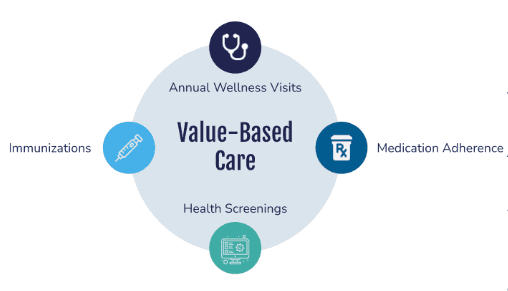

Medicaid is a federal and state government program that provides free or very low-cost comprehensive healthcare coverage to people with low incomes. If the ACA marketplace premiums become unaffordable, you should always check if you or your children have become newly eligible for Medicaid or the Children's Health Insurance Program (CHIP).

- Eligibility is Year-Round: Unlike ACA plans, you can apply for Medicaid at any time of the year—you don't need a special enrollment period.

- Income Threshold is Key: In the 40 states and D.C. that expanded Medicaid, eligibility is generally limited to adults with household income up to 138% of the Federal Poverty Level (FPL) (around $20,000 for an individual) [1.1, 3.4]. If your income is below this level, you must enroll in Medicaid and cannot receive ACA subsidies.

- Coverage is Comprehensive: Medicaid is often considered superior to many private plans in terms of cost-sharing, as it typically involves no premiums, no deductibles, and very low (or zero) copayments [3.4]. It covers the full range of Essential Health Benefits.

2. The Risky Alternative: Understanding Short-Term Plans

Short-Term Health Insurance Plans are temporary, non-ACA compliant medical policies designed to fill gaps in coverage (e.g., between jobs or while waiting for an ACA plan to start). While their premiums are often significantly lower than unsubsidized ACA plans, they carry major risks.

Key Differences: ACA vs. Short-Term Plans

The table below highlights the crucial coverage and cost differences.

Feature ACA-Compliant Plan (Marketplace) Short-Term Health Plan (Non-ACA)

Pre-Existing ConditionsYES. Must cover them with no exclusions.NO. You can be denied coverage or have claims related to any past condition rejected.Essential Health BenefitsYES. Must cover 10 EHBs (e.g., mental health, maternity).NO. Coverage is limited; often excludes maternity, preventive care, or prescription drugs [2.2].Coverage GuaranteeGuaranteed Issue. Cannot deny you coverage.Medically Underwritten. Can deny you coverage based on a health questionnaire [2.2].Coverage DurationAnnual, renewable coverage.Temporary. Policies typically last only 1-12 months and may not be renewable in some states [2.4].Financial AssistanceYES. Premium Tax Credits and CSRs are available.NO. Subsidies are unavailable.

Comparison Summary: Which is Right for You?

Choose Medicaid If... Choose ACA/Marketplace If... Choose Short-Term If...

Your income is below 138% FPL (in expansion states).You qualify for subsidies (even reduced ones) to make the premium affordable.You are very healthy, need coverage for only a few months, and missed the Open Enrollment deadline.You require comprehensive care with minimal out-of-pocket costs.You need coverage for pre-existing conditions or prescription drugs.You cannot enroll in an ACA plan and need an immediate, temporary stop-gap.

The bottom line: Short-term plans should only be considered as a last resort when you are ineligible for both Medicaid and an ACA plan (including a Special Enrollment Period) and need coverage for a very limited time. For long-term security and protection against catastrophic illness, the ACA Marketplace, even with higher premiums, offers essential financial protections that Short-Term plans lack.

FAQ: Questions on Alternative Coverage

If I choose Medicaid, can I switch to a subsidized ACA plan if my income goes up later?

Yes. If your income increases above the Medicaid threshold (e.g., above 138% FPL), you lose Medicaid eligibility. This loss of coverage triggers a Special Enrollment Period (SEP) in the Marketplace, allowing you to sign up for an ACA plan and qualify for subsidies immediately [1.7].

Can I face a tax penalty if I choose a Short-Term Health Plan?

No. Since 2019, the federal tax penalty for not having ""minimum essential coverage"" was eliminated. However, be aware that some states have their own individual mandates and penalties (like Massachusetts, New Jersey, and California) [2.2].

Do Short-Term plans cover basic doctor visits and emergency services? Most Short-Term plans cover emergency services and office visits, but the extent of coverage varies widely and often comes with a high deductible and benefit limits. The key risks remain the exclusion of pre-existing conditions and the lack of coverage for essential benefits like maternity care and mental health [2.1, 2.3].

Credible Citations

[1.1] Verywell Health. (2025). Key Differences Between Medicaid and Obamacare. https://www.verywellhealth.com/whats-the-difference-between-medicaid-obamacare-1738843

[1.7] Reddit Discussion (r/HealthInsurance). (2025). marketplace insurance vs medicaid: trying to understand benefits and costs. https://www.reddit.com/r/HealthInsurance/comments/1ka3uzo/marketplace_insurance_vs_medicaid_trying_to/

[2.1] Stride Blog. (2025). Why Choose ACA vs. Short-Term Health Insurance. https://blog.stridehealth.com/post/why-choose-aca-versus-short-term-health-insurance

[2.2] https://www.google.com/search?q=GetHealthInsurance.com. (2025). Short Term Medical Insurance and ACA Comparison. https://www.gethealthinsurance.com/short-term-health-insurance/short-term-health-insurance-vs-aca-health-plans.html

[2.3] PivotHealth.com. (2025). How Do Short Term and ACA Health Insurance Plans Differ?. https://www.pivothealth.com/how-do-short-term-and-aca-health-insurance-plans-differ-13716

[2.4] UnitedHealthcare. (2025). Short term health insurance. https://www.uhc.com/individuals-families/short-term-health-insurance

[3.4] SmartAsset.com. (2025). Medicaid vs. Obamacare: Costs, Benefits and Enrollment. https://smartasset.com/insurance/medicaid-vs-obamacare