Health Insurance Explained

Government Shutdown Ended - Future of Health Insurance Subsidies

RateQuote Direct,

Government Shutdown Ended: What's Next for Your ACA Health Insurance Subsidies?

The recent federal government shutdown has ended, but the core issue that stalled the funding bill—the future of enhanced Affordable Care Act (ACA) Premium Tax Credits—remains unresolved by Congress. For the millions of Americans currently relying on these subsidies to lower their monthly health insurance premiums, this means a significant financial uncertainty is still looming for the upcoming 2026 plan year. Without congressional action to extend them, the enhanced subsidies will expire at the end of 2025, which could lead to substantial premium increases for many enrollees.

Why Your Premiums Could Increase Significantly

The current situation revolves around the temporary enhanced premium tax credits originally introduced by the American Rescue Plan Act (ARPA) in 2021 and extended through the Inflation Reduction Act (IRA) in 2022. These enhancements significantly lowered the cost of coverage and expanded eligibility for financial help, including eliminating the ""subsidy cliff"" for higher earners.

| Key Feature | Permanent ACA Law (Starting 2026) | Enhanced ACA Subsidies (Through 2025) |

If Congress does not pass an extension before the deadline, these enhanced provisions will revert to the original, less generous terms on January 1, 2026.

The Financial Impact:

- Premium Spike: Analyses from groups like the Kaiser Family Foundation (KFF) project that average ACA premium payments could more than double for subsidized enrollees if the enhanced credits expire, with some enrollees seeing their costs triple [1].

- Loss of Coverage: The Congressional Budget Office (CBO) estimates that the expiration of the enhanced subsidies could lead to roughly 4 million people becoming uninsured who would otherwise have coverage [2].

The Current Political Limbo

While the government has reopened, the fight over the ACA subsidies has merely been postponed. The stopgap measure that ended the shutdown did not include an extension of the tax credits.

- Congressional Promise: As part of the deal to end the shutdown, some Senate Republicans reportedly agreed to hold a vote on extending the ACA subsidies by mid-December 2025 [3]. However, a vote is not a guarantee of passage, and House Republicans have not yet committed to a similar vote.

- Open Enrollment Reality: Open Enrollment for 2026 coverage began on November 1st. Millions of people are currently shopping for plans and receiving notices of their higher, unsubsidized 2026 premiums because insurers must base their quotes on current law (which anticipates the expiration). This means consumers are making crucial decisions under a cloud of significant financial uncertainty.

What ACA Enrollees Should Do Now (Action Steps) 💡

Given the ongoing uncertainty, it is crucial for ACA enrollees to take proactive steps while Congress debates a solution.

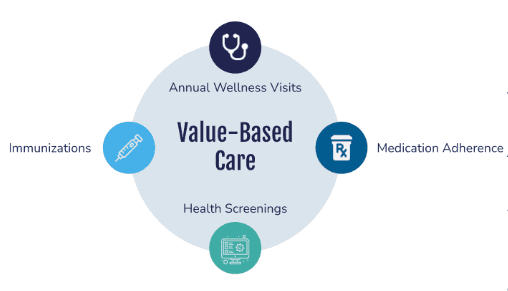

Review Your Renewal Notice Carefully: Pay close attention to the gross premium (the total cost before subsidies) and the net premium (what you will pay after the currently projected subsidy). Understand the full cost of your plan if the enhanced credits are not extended.

Compare All Options: Even with higher estimated costs, you must complete your enrollment or re-enrollment by the Open Enrollment deadline. Compare different metal tiers (Bronze, Silver, Gold) and different insurance companies. A different plan might offer a lower premium even without the full subsidy.

Consider the ""Silver Loading"" Effect: Remember that the permanent ACA subsidy is tied to the second-lowest-cost Silver plan. In some states, a phenomenon called ""silver loading"" may make Bronze plans or even low-cost Gold plans a better value, especially for those who still qualify for Cost-Sharing Reductions (CSRs) on Silver plans.

Stay Informed: Monitor reliable, non-partisan sources for updates on congressional negotiations. You may need to change your plan if a subsidy extension is passed and retroactive price adjustments are announced.

FAQ: Your Top Questions Answered

Will I lose my health insurance coverage immediately because the government shutdown ended without a deal on subsidies?

No. The end of the government shutdown does not immediately impact your current health insurance coverage. The enhanced subsidies are scheduled to expire at the end of 2025. Any changes to your costs will start with your plan for the 2026 calendar year.

If Congress extends the subsidies after I’ve already enrolled for 2026, will I get a refund?

Yes, in most cases. If an extension is passed and made retroactive to January 1, 2026, state and federal marketplaces would work with insurers to adjust the pricing. This would likely result in a lower monthly premium going forward and potentially a refund for any excess premiums you paid in January.

What exactly are the ""enhanced"" subsidies that are set to expire?

The ""enhanced"" subsidies are the temporarily increased Premium Tax Credits provided by ARPA and IRA. They made coverage significantly more affordable by reducing the percentage of income an individual must contribute toward a benchmark plan and by eliminating the income cap for eligibility (the 400% FPL ""cliff"").

Credible Citations

[1] Lo, J., Levitt, L., Ortaliza, J., & Cox, C. (2025, September 30). ACA Marketplace Premium Payments Would More Than Double on Average Next Year if Enhanced Premium Tax Credits Expire. KFF. https://www.kff.org/... (Note: KFF analysis cited in multiple search results)

[2] Congressional Budget Office (CBO). (2025, October 15). The Effects on Health Insurance Coverage and Premiums of Allowing the Increased Premium Tax Credits to Expire. https://www.cbo.gov/... (Note: CBO estimate cited in search results)

[3] PBS NewsHour. (2025, November 13). Democrats are wary of GOP promise to negotiate health care after end of shutdown. https://www.pbs.org/newshour/...https://www.pbs.org/newshour/politics/democrats-are-wary-of-gop-promise-to-negotiate-health-care-after-end-of-shutdown)