Health Insurance Explained

The Open Enrollment Checklist

RateQuote Direct,

The 2026 ACA Open Enrollment Period is open, running from November 1, 2025, to January 15, 2026, in most states. However, this year presents a significant challenge: you must shop for your 2026 plan knowing that the generous enhanced Premium Tax Credits are set to expire on December 31, 2025, unless Congress acts. This guide provides a clear, five-step checklist to help you navigate this period of financial uncertainty, compare plans accurately, and enroll by the December 15th deadline for coverage starting January 1st.

The 5-Step Uncertainty Action Plan for 2026 Enrollment

The primary goal of this enrollment period is to manage risk. Do not simply auto-renew; you must actively compare plans using two financial scenarios: with and without the enhanced subsidies.

Step 1: Gather ALL Documents and Deadlines

Before logging into HealthCare.gov or your State Marketplace, have these items ready.

- Income Proof: Recent pay stubs, W-2s, or your most recent tax return (2024 or 2025). The Marketplace needs your projected 2026 Modified Adjusted Gross Income (MAGI) to calculate subsidies.

- Current Plan Details: Have your 2025 Form 1095-A handy to compare current costs (premiums, deductibles, copays) against the new 2026 offerings.

- Key Deadlines:

- December 15, 2025: Deadline to enroll for coverage that begins January 1, 2026.

- January 15, 2026: Final deadline to enroll in most states (coverage starts February 1). Note: Idaho's deadline is December 15th, and some state-based exchanges (like CA and NY) extend beyond January 15th [2.2, 2.3].

Step 2: Run the Numbers: Scenario Planning for 2026

Your biggest hurdle is the expiration of the enhanced subsidies, which could increase your premiums by an average of 114% [1.4]. You must check two scenarios:

Current Scenario (With Subsidies): Review the net premium (what you pay) shown on the Marketplace based on the current law. This is the best-case scenario.

Worst-Case Scenario (Without Subsidies): Use a trusted external calculator (like the KFF tool) to input your income, age, and family size to see what your net premium would be if the subsidy enhancements expire. This is your Maximum Affordable Price [1.1].

Step 3: Strategically Compare Metal Tiers

With the subsidy expiration and high market uncertainty, the value of the different ""metal tiers"" (Bronze, Silver, Gold) shifts significantly:

- Low-Income Enrollees (100%–250% FPL): Silver is still the best option. You remain eligible for Cost-Sharing Reductions (CSRs), which lower your deductibles and copays, regardless of the enhanced subsidy expiration [1.2].

- Middle-Income Enrollees (250%–400% FPL): Re-evaluate Gold and Bronze plans.

- Gold plans may be a better value than Silver. Due to the practice of ""silver loading"" (where insurers load the cost of CSRs onto Silver plans), the higher pre-subsidy cost of Silver often drives up the subsidy, which can sometimes make a Gold plan with better benefits cheaper after applying the smaller, original premium tax credit [3.3, 3.4].

- Bronze plans offer the lowest premiums but carry the highest deductibles. This is a higher-risk option but may be necessary for cost-conscious shoppers preparing for the subsidy loss.

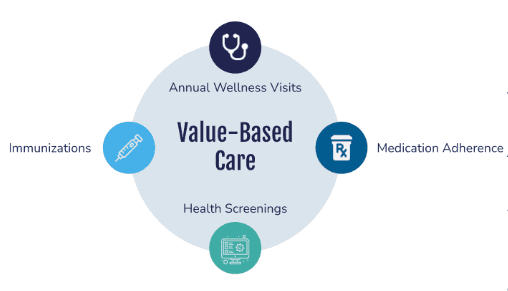

Step 4: Verify Provider and Prescription Networks

Premium increases aside, the network is non-negotiable.

- Check the Directory: Confirm that all your key physicians, specialists, and the hospitals you use are in-network for your chosen 2026 plan.

- Prescription Formulary: Review the plan's formulary (list of covered drugs) to ensure your regular medications are covered, especially if you are switching from a Silver plan to a Bronze or Gold plan.

Step 5: Complete Enrollment by December 15th

To avoid a gap in coverage, you must select your plan and finalize your enrollment by the mid-December deadline.

- Don't Rely on Auto-Enrollment: While most plans auto-renew, you must actively shop this year to account for the subsidy change. Auto-renewal may put you in a plan you can no longer afford in 2026 [2.5].

- Pay Your First Premium: Your coverage is not active until you pay your first month’s premium. Ensure this payment is submitted on time, usually by January 1st.

FAQ: Key Questions on Enrollment Uncertainty

I enrolled and paid for a 2026 plan based on the higher cost. What happens if Congress extends the enhanced subsidies after I enroll?

If Congress extends the enhanced subsidies retroactively for 2026, the Marketplace will notify you. Your premium tax credit will increase, and your monthly premium will decrease. The Marketplace and your insurer will then process a refund for any excess premiums you paid in January and February [4.1].

Will premium tax credits still be available for people with income above 400% of the Federal Poverty Level (FPL)?

Under current law (starting 2026), the ""subsidy cliff"" returns. Eligibility for tax credits is capped at 400% of the FPL. Only if your income falls below that limit will you qualify for the tax credit [1.5].

Why are full-price (unsubsidized) premiums increasing so much for 2026? Insurers proposed an average rate increase of about 18% for 2026 due to several factors, including medical trend (inflation in healthcare costs), labor costs, and the expense of new specialty drugs [1.4]. This is separate from, and compounded by, the expiration of the enhanced subsidies.

Credible Citations

[1.1] KFF. (2025, October 29). Calculator: ACA Enhanced Premium Tax Credit. https://www.kff.org/interactive/calculator-aca-enhanced-premium-tax-credit/ [1.4] KFF/Health System Tracker. (2025, August 6). How much and why ACA Marketplace premiums are going up in 2026. https://www.healthsystemtracker.org/brief/how-much-and-why-aca-marketplace-premiums-are-going-up-in-2026/

[1.5] Bipartisan Policy Center. (2025, October 15). Enhanced Premium Tax Credits: Who Benefits, How Much, and What Happens Next?. https://bipartisanpolicy.org/issue-brief/enhanced-premium-tax-credits-who-benefits-how-much-and-what-happens-next/

[2.2] eHealth. (2025, October 6). 2026 Healthcare Insurance Open Enrollment Dates by State. https://www.ehealthinsurance.com/resources/individual-and-family/obamacare-open-enrollment-dates-by-state

[2.5] Healthcare Insider. (2025, November 7). 2026 ACA Open Enrollment Survival Guide. https://healthcareinsider.com/2026-aca-open-enrollment-guide

[3.3] Premera Producers (WA). (2025, August 14). What You Need to Know About Uniform Silver Loading and Enhanced Premium Tax Credits in 2026. https://producernews.premera.com/what-you-need-to-know-about-uniform-silver-loading-and-enhanced-premium-tax-credits-in-2026/