Health Insurance Explained

The Subsidy Cliff Breakdown

RateQuote Direct,

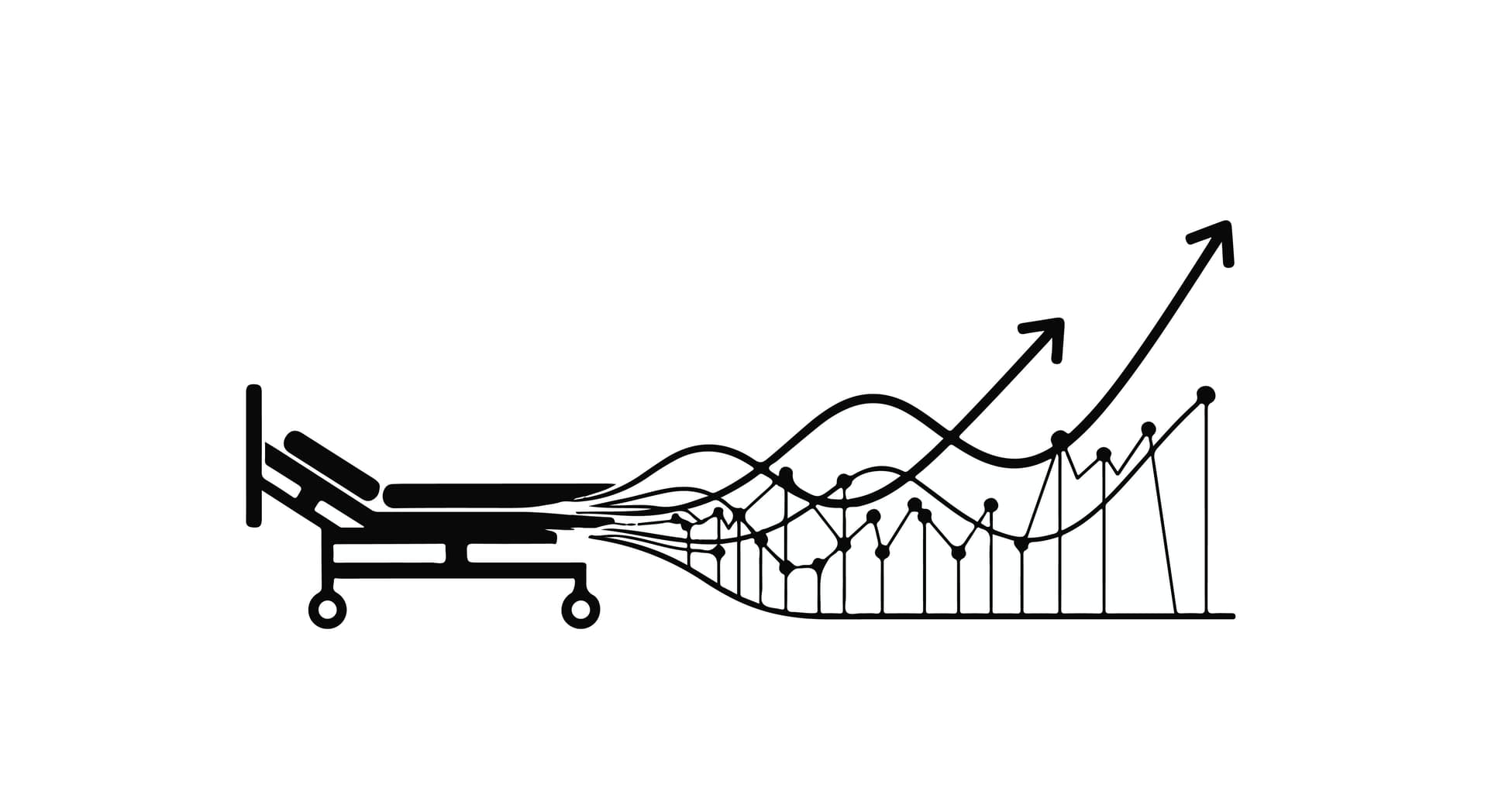

The expiration of the enhanced Affordable Care Act (ACA) Premium Tax Credits (PTCs) at the end of 2025 will reintroduce the notorious ""subsidy cliff."" This means that financial assistance will no longer be available to anyone with a household income above 400% of the Federal Poverty Level (FPL), and subsidies for those under 400% FPL will become significantly less generous [1.1, 1.2]. While virtually all subsidized enrollees will pay more to keep their current plan in 2026, the steepest financial shock will hit middle-income earners just over the 400% FPL limit, particularly older adults nearing retirement.

Understanding the Return of the Subsidy Cliff

The original ACA law capped subsidy eligibility at 400% FPL (which is approximately $62,600 for a single person or $128,600 for a family of four in 2025) [1.6]. If you earned one dollar over this threshold, you lost your entire subsidy and had to pay the full, unsubsidized premium—the ""cliff.""

The temporary enhancements (from 2021-2025) eliminated this cliff by extending subsidies to all incomes as long as the benchmark plan premium exceeded 8.5% of the household income.

Scenario Maximum Premium Contribution Income Eligibility Limit Financial Risk

Enhanced PTCs (Through 2025)Capped at 8.5% of income.No income cap (Subsidy Cliff eliminated).Low and predictable.Permanent ACA Law (Starting 2026)Rises to 9.5% - 10% of income (for those at 400% FPL).400% FPL is the hard cutoff (Subsidy Cliff returns).High and unpredictable, especially near 400% FPL.

Case Study: The Steepest Climb for Older Middle-Income Adults

The return of the subsidy cliff disproportionately harms older, middle-income adults (ages 50-64) for two main reasons:

Age-Based Premiums: The ACA allows insurers to charge their oldest customers (ages 50-64) up to three times the premium they charge their youngest customers for the same plan.

Loss of All Subsidy: When a person in this high-premium age group earns just over 400% FPL, they lose all financial assistance, leaving them to bear the full cost of the highest unsubsidized premiums.

Example: 60-Year-Old Couple (402% FPL)

- Income: Approximately $85,000 (just over the 400% FPL threshold for a couple).

- Current Cost (2025): Premium capped at 8.5% of income (approx. $7,225/year).

- Potential 2026 Cost (Without Subsidy): Full unsubsidized benchmark premium, which KFF estimates could be over $22,600 per year (due to high age-based rates and an average 18% gross premium increase) [1.6, 3.2].

For this family, the expiration of the subsidy is not a slight increase; it's a $15,000+ premium spike that raises their health coverage cost to nearly 25% of their income [1.6].

Premium Increases Across All Income Levels

While the cliff is most dramatic for high-earners, all subsidized enrollees will see an increase due to the return to less generous contribution caps.

Household Income (Example Individual) 2025 Premium Payment (Enhanced PTC) 2026 Premium Payment (If PTC Expires) Annual Increase

Low-Income (179% FPL / ~$28k)1.2% of income ($325)5.6% of income ($1,562)$1,238Mid-Income (351% FPL / ~$55k)7.3% of income ($4,010)10% of income ($5,478)$1,469**Cliff Hit (>400% FPL / ~$65k)**8.5% of income ($5,525)No Tax Credit (Full Price)Varies widely, but likely $10,000+

Note: Data based on KFF analysis, assuming an 18% underlying premium increase in 2026 [3.1].

FAQ: Key Questions on the Subsidy Cliff

If I'm over the 400% FPL and lose my subsidy, does that mean I lose my insurance?

No, you do not lose the insurance policy itself, but you lose the financial assistance to pay for it. You would be responsible for 100% of the premium cost. Many people in this situation will find the cost unaffordable and may choose to drop coverage, which could lead to an estimated 4 million Americans becoming uninsured [2.1].

Are there any groups under 400% FPL who will still have a $0 premium plan?

Yes. Under both the current enhanced subsidies and the permanent law, people with incomes under 150% of the FPL often have their premiums effectively reduced to zero for the benchmark Silver plan, and their out-of-pocket costs are lowered significantly by Cost-Sharing Reductions (CSRs) [1.6]. While their costs may increase slightly, they are the most protected group.

Does the subsidy cliff affect Cost-Sharing Reductions (CSRs)?

No. CSRs, which lower your deductibles and copays, are a separate benefit provided to those with incomes between 100% and 250% FPL who enroll in a Silver plan [1.6]. These cost reductions are not affected by the expiration of the enhanced premium subsidies.

Credible Citations

[1.1] Healthinsurance.org. (2025). 2026 Obamacare subsidy calculator. https://www.healthinsurance.org/obamacare/subsidy-calculator/ [1.2] KFF. (2025, October 8). A Steep Subsidy Cliff Looms for Older Middle-Income Enrollees if ACA Enhanced Tax Credits Expire. https://www.kff.org/quick-take/a-steep-subsidy-cliff-looms-for-older-middle-income-enrollees-if-aca-enhanced-tax-credits-expire/ [1.6] Bipartisan Policy Center. (2025, October 15). Enhanced Premium Tax Credits: Who Benefits, How Much, and What Happens Next?. https://bipartisanpolicy.org/issue-brief/enhanced-premium-tax-credits-who-benefits-how-much-and-what-happens-next/

[2.1] AJMC. (2025, October 31). 5 Consequences If ACA Premium Subsidies End in 2026. https://www.ajmc.com/view/5-consequences-if-aca-premium-subsidies-end-in-2026

[3.1] KFF. (2025, September 30). ACA Marketplace Premium Payments Would More than Double on Average Next Year if Enhanced Premium Tax Credits Expire. https://www.kff.org/affordable-care-act/aca-marketplace-premium-payments-would-more-than-double-on-average-next-year-if-enhanced-premium-tax-credits-expire/