Health Insurance Tips & Tricks

Navigating the Health Insurance Marketplace

RateQuote Direct,

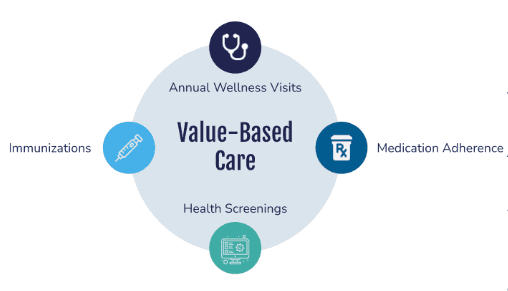

Access to quality healthcare is a cornerstone of a thriving community, and enrolling in the Health Insurance Marketplace is a crucial step toward ensuring you and your family have the coverage you need. As the landscape of healthcare evolves, understanding the enrollment process becomes increasingly important. In this article, we'll guide you through the key steps and considerations when enrolling in the Health Insurance Marketplace.

The Marketplace offers a variety of health insurance plans, each with its own coverage options, costs, and benefits. Take the time to carefully review and compare plans to find one that aligns with your healthcare needs and budget. Consider factors such as monthly premiums, deductibles, co-payments, and the network of healthcare providers.

Certain life events may qualify you for a Special Enrollment Period, allowing you to enroll outside the standard open enrollment period. Qualifying events include changes in household size, income, or the loss of other health coverage. Be sure to check your eligibility for special enrollment to take advantage of these opportunities.

Before enrolling, gather essential information such as social security numbers for all members of your household, income details, and information about any existing health coverage. Having these details on hand will streamline the enrollment process and ensure accurate information is provided.

Navigating the Health Insurance Marketplace can be complex, but you don't have to go through it alone. Certified enrollment counselors, insurance brokers, and healthcare navigators are available to provide assistance. They can answer your questions, guide you through the application process, and help you understand your coverage options.